Passive versus Active Investing

Much has been written about the benefits of active versus passive investing and depending on market conditions, one approach is inevitably more popular than the other.

Broadly speaking active investing is defined as the process of researching and picking the best stocks to buy or hiring a professional fund manager who takes an active approach to do it for you. Implicit in this process is the assumption that it is better to hold certain stocks over others in an attempt to outperform the market as measured by a benchmark or Index.

In contrast, the passive investor aims to replicate the returns of an Index at the lowest possible cost. While some investors relish the challenge of trying to pick their own stocks, others are happy to let someone else do the work for them.

But the active-versus-passive decision doesn’t have to be a ‘one or the other’ choice. Investors can combine the two.

Passive investor

A passive investor is someone who has little or no time in which to select and manage stocks in their portfolio. Yet they want to achieve good returns over the medium to long term.

If this is you, it is recommended you stick to the top 20 stocks in the share market and look to hold between 8 and 12 stocks at any one time, so as not to over-diversify your portfolio. While it is not advisable to embrace a “set and forget” mentality, they are the top stocks on the market for good reason and, therefore, they are more forgiving.

That said, if you decide to buy and hold you must accept the potential risk you are taking is higher, meaning the rewards will be lower than if you actively managed your portfolio on a regular basis.

As your capital grows, you may decide to take a more active approach. From experience, I have found that once the passive investor begins to make money, they miraculously find more time to devote to managing their investments.

Active investor

An active investor, as the name suggests, is more active in selecting stocks and managing their portfolio, dedicating a few hours a month. Due to time constraints, the active investor’s knowledge of the stock market is generally limited, although they do recognize that taking an active approach to managing their portfolio has the potential to optimise their returns.

Typically, an active investor turns over, on average, 20 to 30 per cent of the stocks in their portfolio in a year, although this will depend on market conditions. Given that the active investor is constrained by time, I would, once again, recommend developing a portfolio of between 8 and 12 stocks from the top 20 on the market, although, depending on your level of knowledge, you may want to consider stocks out to the top 50.

As your circumstances change and you have more time, you may want to widen your horizons to include a few more stocks from the top 50 to 150, although this will depend on the type of portfolio you select.

If you are new to the stock market, you may want to manage part of your portfolio actively until you build up your knowledge and confidence level. For example, if you have $50,000 to invest, you may want to place 70 per cent in a passive investing strategy and actively manage the other 30 per cent.

As your confidence and knowledge increases, you would increase the amount being actively managed over time, while still maintaining a maximum of 12 stocks.

Actively managing a portfolio

For those of you that watch this channel regularly, you will know that I am not a big advocate of over-diversification as this exposes you almost exclusively to market risk, which cannot be eliminated by diversification.

In fact research has proven that you only require between 5 and 12 stocks in a portfolio to achieve maximum diversification and minimum risk.

Many of you would are familiar with my best-selling book “How to Beat the Managed Funds by 20%” and my more recent book “Accelerate Your Wealth” where I show you how to achieve very profitable returns by investing directly in the stock market.

My intention when I wrote these books was to show you how, by implementing some simple yet effective investment strategies, you could earn much more than the average return you receive when investing in a managed fund or when trading the stock market.

Effectively, I wanted to demonstrate how, if the managed funds were returning 10 per cent, you could make 12 per cent.

It would appear, however, that the simplicity of the strategies I outlined in my books not only amazed many readers, but inspired a lot to take control and invest directly to achieve very rewarding returns.

How rewarding you ask?

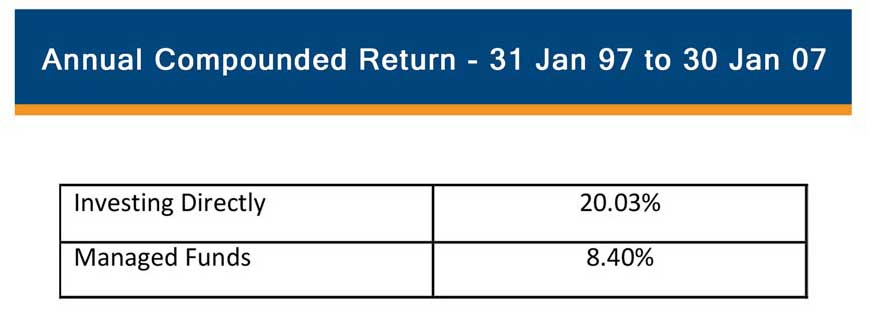

Would it surprise you to know that the average annual return I achieved trading the top 20 stocks on the Australian market from 31 January 1997 to 30 January 2007, as outlined in my first book, How to Beat the Managed Funds by 20% was 52.09 per cent, which equates to an annual compounded return of 20.03 per cent.

In comparison, the managed funds averaged an annual return of around 8.4 per cent over the same period.

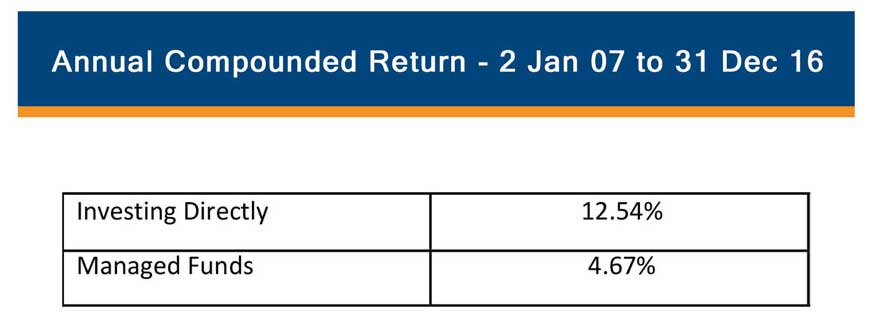

And in my most recent book, Accelerate Your Wealth, I continue to invest from 2 January 2007 to 31 December 2016, taking into account the GFC to demonstrate why the strategies I outline in my books are so powerful.

The gain achieved from capital growth and dividends during this period (taking into account all corporate actions) equated to 225.82 percent or an average annual return of 22.58 percent. This equates to a compounded rate of return of 12.54 per cent.

In comparison over the same 10 year period, the managed funds returned 4.67 per cent as published by Canstar Research.

So as you can see, by simply concentrating your portfolio in the top performing stocks on the market, you can not only achieve very profitable returns but outperform the managed funds by a significant margin.