Wealth Within Individually Managed Accounts

Fast Track Your Financial Future

Achieving consistent and solid returns means partnering with a company who has proven over time that it is timing the market, not time in the market that makes all the difference

Wealth Within offers a unique individually managed account service tailored to the needs of investors seeking direct ownership of their share market investments.

Known as the Direct Equity Individually Managed Account Service, it provides all of the benefits of being a shareholder without the headaches of running your own investment portfolio.

We offer a solution to your investment goals like no other boutique investment company can and we make your money work harder, so you are free to enjoy life.

With our Managed Accounts you get:

- Customised stock selection

- Beneficial ownership of all assets

- Over 45 years of combined investment expertise

- Returns that outperform the market average

- Full portfolio administration

- Investments in leading ASX companies

- Competitive fee structure

- Comprehensive online reporting 24/7

Tap into the unique benefits of our individually managed accounts services from as little as $100,000 today.

Ready To Learn More?

Please use the form below to request the Direct Equity Managed Account Product Disclosure Statement (PDS). By completing the form, I consent to Wealth Within contacting me to discuss any question I may have.

Maximise Your Returns With Proven Investment Techniques and Strategies

Unlike many separately managed account providers that operate on the basis of a modelled portfolio, whereby your funds are invested in a pre-existing portfolio of assets, the benefit of individually managed accounts is that they are customised to identify the best performing opportunities at the time you invest with a view to maximising the returns on your investment.

This is based on our philosophy, which combines 'timing the market' with 'time in the market' to seek to maximise the return on your investments. The benefit to you is that you will not be buying into an existing and what may be a less relevant and less timely portfolio.

Backed By A Team Of Expert Strategists

In selecting investments, we focus on securities within the S&P/ASX 300 (depending on the investment strategy you choose heavily weighted to the top 100), which our research and investment team believes can deliver strong returns over the medium to long term.

Using disciplined investment processes, together with a strong client focus, Wealth Within aims to help you consistently outperform the market over the medium to long term.

Make Your Money Work Harder

They want results that outperform the market average and personable service. And they come to Wealth Within because they know we provide the knowledge and investment expertise that makes this happen.

Usually only reserved for sophisticated investors with $500,000 or more to invest, Direct Equity now enables retail investors to tap into the benefits of our individually managed accounts.

Request More Information

Getting Started In 3 Simple Steps

Download PDS

Click the button below to request a copy of the Product Disclosure Statement.

Connect With Our Specialists

Our team will connect with you, answer any questions and determine if we're a good fit.

Have Your Money Work Smarter

We'll prepare a customised portfolio tailored to your individual needs and goals.

Frequently Asked Questions

Making A Difference

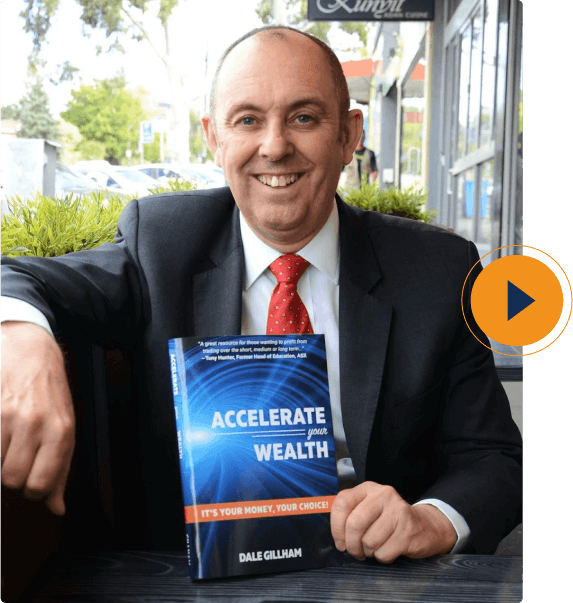

Wealth Within was co-founded in 2002 by Dale Gillham to provide a range of solutions to support our clients achieve their financial goals.

Our mission has always been "customer first in everything we do" – which means breaking down a lot of the myths in the market that hold individuals back from achieving their financial goals.

5 Stars

Years in business delivering high-quality education

of students rate the quality of education as excellent

of students recommend Wealth Within to others

What I have learnt by studying with Wealth Within has provided me an unlimited capacity to make money and to be self-supportive…

Anna Mowbray

I had 10 wins out of 10 trades and I am extremely happy as I have consistently had more wins than losses, which means I am well in front…

Peter Simpson

I am currently trading at a 65% success rate and I am way up on my trading from where I would be if I hadn't completed the Diploma…

Theo Perifanos

My goal was to be self-sufficient from trading and my advice to new traders is don’t jump into the market on speculation, it’s way better to trade on confirmation...

Nathan Moseley

Learn How To Master The Stock Market

We’ve proven that the stock market doesn’t reward information. It rewards execution confidence, and discipline, which is achieved by having the right knowledge. That’s exactly what you’ll learn inside this free guide that reveals the core principles of how you can become a consistently profitable trader.

Download The Free Report